The Retail Evolution Continues

08.29.2017

Competitors or Complements?

Since the beginning, online retail has primarily been viewed as a competitor to traditional brick and mortar retail. As online sales grew, store fronts were said to suffer and with good reason. Each year stores and retailers continued to close, seemingly under the boot of rising online retailers like Amazon. This leaves one to wonder when the final hammer will fall and signal the end of storefronts altogether. And yet, stores persist, perhaps forcing us to abandon the hyperbole for evolutionary thinking and to reconsider the central question – is online ultimately competing with in-store, or are they complementary?

The strictly competitive view of eCommerce was the dominant thinking in phase one of the evolution, which emphasized a brute force response. Taking the mob head-on, stores began slashing prices to outcompete their online counterparts. The result was predictable in any lopsided conflict. Those who didn’t have low cost infrastructure couldn’t survive the pricing blitz, leading to massive casualties in the form of broken balance sheets and closing stores. Enter phase two, summarized by the old adage ‘if you can’t beat them, join them.’ At this point, traditional retailers created their own web presence hoping to bring some sales back.

Even through this strategy, success was mixed; consumers bought online from the retailer, but locations still suffered as sales were attributed to the online channel and consumers used mobile devices to show-room and cross-shop to find the lowest price. However, despite all this, consumers continued to come into stores, suggesting a thread of opportunity for bringing about phase three of retail, one in which the online and in-store experiences began to blend in creative ways to improve the overall shopping experience for consumers.

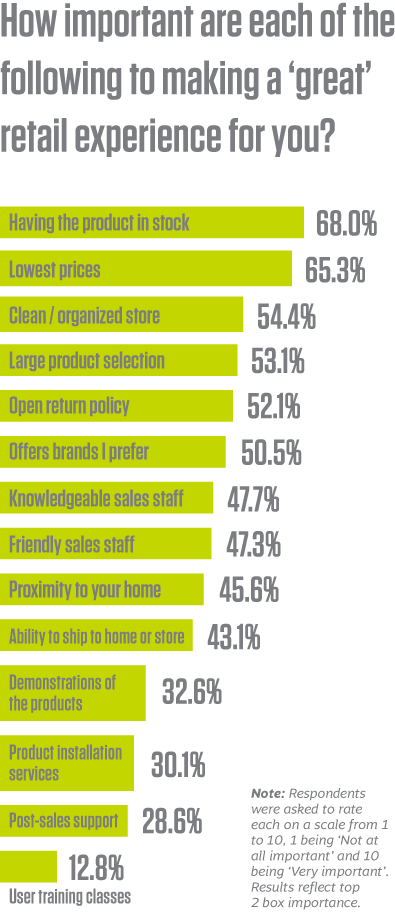

The first step towards success in phase three is to better understand what consumers expect from retail:

Ultimately, the evolutionary journey has taught us several things, each of which illuminated the way for a blended approach to emerge:

1. Price and availability can’t be ignored.

Look at the results of any consumer survey about shopping behaviors and you will see price as a key decision factor, and the same is true for product availability. BDS research shows the same; consumers said price and product availability were the top two reasons why they made their most recent purchases from a specific retailer. However, this doesn’t mean online won – most shoppers (62%) also said that they ended up making their purchase in-store. A slightly higher percentage (70%) even went further to say they are not ready to abandon in-store shopping altogether in favor of online only.

2. Consumers value the in-store experience.

With so many online retailers to choose from and to use for price comparison, how does the store win? Two things – providing the consumers the ability to touch and see the products before buying and the immediacy of the purchase. Seeing the options laid out in front of the shopper also appeals to some since these consumers may find it easier to do this in real time and space. Generally having fewer options to choose from may make in-store browsing more appealing as well.

3. Online is convenient and primes the pump.

Flipping this around, 38% did decide to buy online rather than in a store and 30% agreed they are ready to shift to online shopping only. Motivations here center around price and availability of product, especially for a person who doesn’t have an immediate need to receive the product. Browsing online was also listed as a top motivator for many, given the sheer variety of options available online. This also helps to explain why retailer websites came up as one of the most used and most important touch-points along the consumers’ path to purchase. Consumers often start their journey online before going into a store.

The question is – do consumers want an integrated experience?

If the conversation for consumers indeed starts with online research and then continues into the store with browsing and interaction with a retail sales associate, does this mean they would like a better assimilation between those two experiences? BDS asked consumers how likely they would be to shop and buy from a retailer who utilized data on their online shopping activities to help prime the pump in the store through targeted offers and scheduled time with an associate. On net, consumers were more likely than unlikely to shop at such a retailer, but the majority (67%) expressed concerns over the privacy they would give up. This would seem to be the key – overcoming these concerns by demonstrating the benefits associated with the integrated experience.

Fortunately, our research shows that the window is open. Shoppers of all types can agree that retail could be better, even though more shoppers said this about the in-store experience (63%) than online (53%). Where to start? Sales associate interactions were near the top of the list for consumers. Armed with so much information online, consumers now expect their associates to be similarly equipped so that their conversation can truly continue. Preparing these associates with a sense for where the shopper has been thus far on his/her journey would go a long way to ensuring a more level encounter. Once again, the benefits must be clear. The question is are we, as an industry, ready to deliver?

Whether it’s optimizing your existing in-store experience or finding ways to integrate your online and brick-and-mortar strategies, BDS can help. Contact us today to find out how we can help you with a customized solution!